Extract the most from your cloud investment

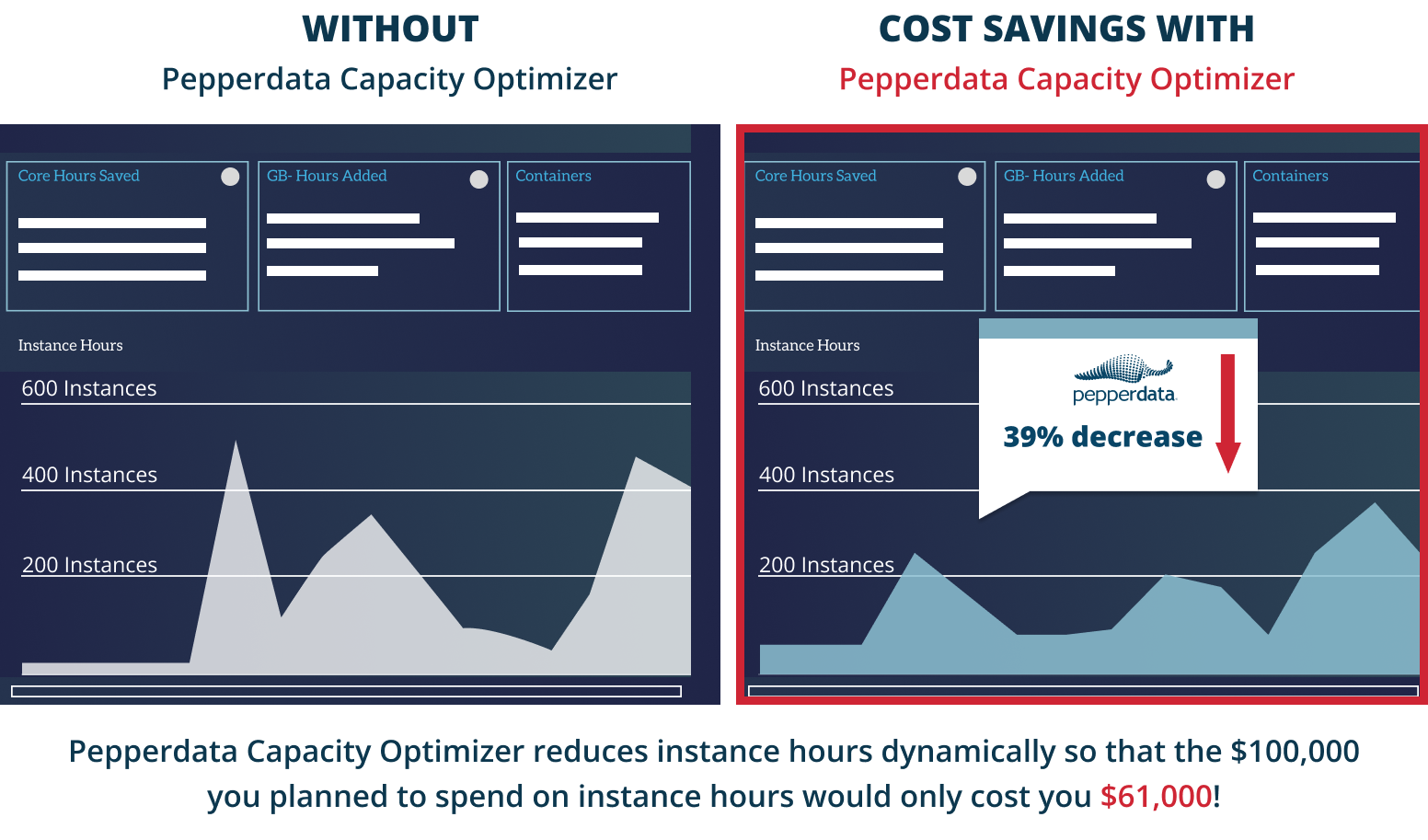

Pepperdata enhances capacity optimization in your clusters in real time to save you 30–47% on average.

-

Reduce Instance Hours immediately

Decrease instance hour consumption by eliminating waste for reduced costs.

-

Optimize Spark clusters for peak efficiency

Optimize resource utilization and run more applications without changing your applications.

-

Tune resources automatically in real time

Free developers from manual resource optimization with automatic waste elimination.

Capacity optimization with Continuous Intelligent Tuning

Using Machine Learning (ML) and patented algorithms, Capacity Optimizer’s Continuous Intelligent Tuning:

- Rapidly identifies where more resource optimization can be done in real time

- Adds tasks to nodes with available resources

- Keeps your clusters running at the sweet spot of peak utilization

The result:

CPU and memory are automatically optimized

More applications can be launched

at equal costs

Developers are free to focus on innovation versus fine tuning apps

Autodesk Reduces Amazon EMR Costs by 50% and Boosts Capacity Optimization with Pepperdata

Pepperdata helped Autodesk successfully reduce Amazon EC2 costs by over 50 percent with real-time capacity optimization for its workloads and continuously optimized resource utilization.

BENCHMARKS

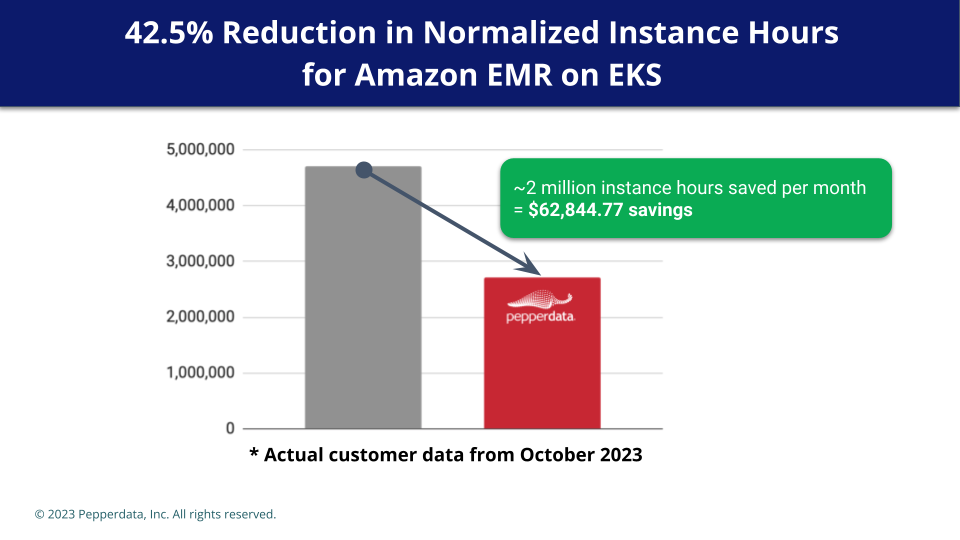

Capacity Optimizer for Spark workloads on Amazon EKS and Amazon EMR

Reduced the total instance hours and related costs by 41.8 percent and enabled the entire workload to run 45.5 percent faster

Enabled a production Amazon EMR workload running on Amazon EKS to run more efficiently and at 42.5 percent reduced cost

Optimized resource utilization with a 157 percent increase in CPU utilization and a 38 percent increase in memory utilization